Broker: Trading Platform

Introduction to Broker

Exness, established in 2008, has become a prominent forex and CFD broker serving Nigerian traders. The company offers a diverse range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. Exness provides access to global financial markets through its advanced trading platforms and competitive trading conditions. Nigerian traders can benefit from the broker’s low spreads, high leverage options, and fast execution speeds. Exness is committed to providing a secure and transparent trading environment for its clients in Nigeria.

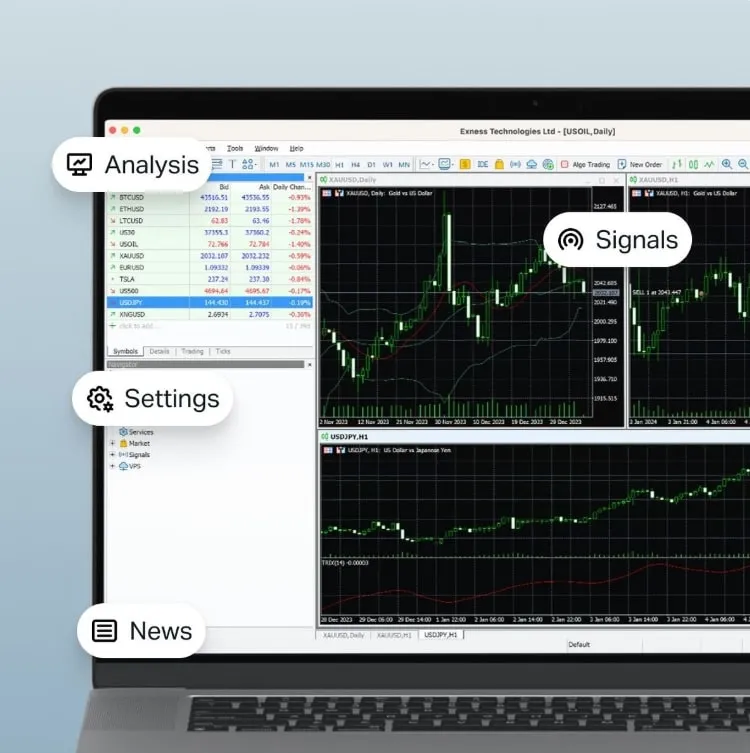

Exness Terminal Features

The Exness Terminal platform includes:

- Over 100 technical indicators

- 9 timeframes for chart analysis

- One-click trading functionality

- Real-time price alerts

- Integration with Trading Central analysis

Trading Platforms and Tools

Exness offers multiple trading platforms to cater to different trader preferences and needs. The primary platforms available to Nigerian traders include:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Exness Web Terminal

These platforms provide advanced charting capabilities, technical indicators, and expert advisors for automated trading. The Exness Web Terminal offers a user-friendly interface accessible directly through web browsers. Nigerian traders can access their accounts and execute trades on-the-go using mobile apps available for both iOS and Android devices.

Account Types and Trading Conditions

Exness offers several account types to suit different trading styles and experience levels. Nigerian traders can choose from the following options:

| Account Type | Minimum Deposit | Spreads | Maximum Leverage |

| Standard | $1 | From 0.3 pips | Up to 1:2000 |

| Raw Spread | $200 | From 0.0 pips | Up to 1:2000 |

| Zero | $200 | From 0.0 pips | Up to 1:2000 |

| Pro | $200 | From 0.0 pips | Up to 1:2000 |

The Standard account is suitable for beginners, while the professional accounts (Raw Spread, Zero, and Pro) cater to more experienced traders seeking tighter spreads and advanced trading conditions.

Leverage and Margin Requirements

Exness offers flexible leverage options, allowing Nigerian traders to maximize their trading potential. The maximum leverage available varies depending on the instrument and account type, ranging from 1:30 to 1:2000. Traders should be aware of the risks associated with high leverage and manage their positions responsibly.

Deposits and Withdrawals

Exness provides Nigerian traders with various options for depositing and withdrawing funds. The broker supports local payment methods to facilitate seamless transactions for clients in Nigeria.

| Payment Method | Deposit Time | Withdrawal Time | Fees |

| Bank Transfer | 1-3 business days | 1-5 business days | No fees |

| Credit/Debit Cards | Instant | 1-3 business days | No fees |

| E-wallets (Skrill, Neteller) | Instant | Up to 24 hours | No fees |

Exness does not charge fees for deposits or withdrawals, although third-party payment providers may apply their own charges.

Local Payment Options

Nigerian traders can utilize local payment methods such as:

- Bank transfers through Nigerian banks

- Mobile money services

- Local e-wallet providers

Educational Resources and Market Analysis

Exness offers a range of educational materials to help Nigerian traders improve their skills and knowledge. These resources include:

- Video tutorials on platform usage

- Trading courses for beginners and advanced traders

- Economic calendar and market news updates

- Daily market analysis and trading signals

The broker also provides access to Trading Central, a third-party analysis provider, offering professional insights and trade ideas.

Customer Support

Exness prioritizes customer satisfaction by offering 24/7 support to Nigerian traders. Support channels include:

- Live chat available directly on the website

- Email support with quick response times

- Phone support for urgent inquiries

- Extensive FAQ section for self-help

Support is available in multiple languages, including English, to cater to the diverse Nigerian trading community.

Regulation and Security

Exness operates under multiple regulatory licenses to ensure compliance with international standards. While not directly regulated in Nigeria, the broker adheres to strict security protocols to protect client funds and data.

Regulatory Authority | Jurisdiction | License Number |

FCA (UK) | United Kingdom | 730729 |

CySEC | Cyprus | 178/12 |

FSCA | South Africa | 51024 |

FSA | Seychelles | SD025 |

Nigerian traders’ funds are held in segregated accounts with top-tier banks, ensuring the safety of client deposits.

Social Trading and Copy Trading

Exness offers social trading features, allowing Nigerian traders to connect with and copy successful traders from around the world. This feature enables beginners to learn from experienced traders and potentially improve their trading results.

Conclusion

Exness provides Nigerian traders with a comprehensive trading environment, combining advanced platforms, competitive trading conditions, and a wide range of instruments. The broker’s commitment to education, customer support, and security makes it a suitable choice for both novice and experienced traders in Nigeria. With its global presence and regulatory compliance, Exness offers a reliable platform for Nigerian traders to access international financial markets.

Feature | Description |

Trading Instruments | 107+ currency pairs, commodities, indices, cryptocurrencies |

Minimum Deposit | $1 (Standard Account) |

Maximum Leverage | Up to 1:2000 |

Spreads | From 0.0 pips (professional accounts) |

Platforms | MT4, MT5, Exness Web Terminal, Mobile Apps |

Frequently Asked Questions:

The minimum deposit for a Standard account with Exness in Nigeria is $1, making it accessible for traders with various budget levels.

Yes, Exness provides Islamic accounts for Nigerian traders who require swap-free trading in accordance with Islamic principles.

Exness supports various local payment methods for Nigerian traders, including bank transfers through Nigerian banks and mobile money services, facilitating convenient transactions.