Exness Sign Up: Account Registration Guide

Getting Started with Exness

Exness provides a straightforward sign-up process for traders looking to access global financial markets. The registration procedure is designed to be quick and user-friendly, allowing new clients to open an account in minutes. Exness offers various account types to suit different trading styles and experience levels. Before initiating the sign-up process, potential traders should familiarize themselves with the available account options and trading conditions. Exness maintains a commitment to regulatory compliance and security throughout the registration process.

Standard Account Features

The Standard Account includes:

- Low minimum deposit requirement

- Competitive spreads from 0.3 pips

- Access to a wide range of trading instruments

- Leverage up to 1:2000 (subject to regulatory restrictions)

- No commissions on trades

Exness Account Types Overview

Exness offers several account types to cater to diverse trading needs. The Standard Account is suitable for beginners, featuring low minimum deposits and standard trading conditions. For more experienced traders, Exness provides Professional Account options, including Raw Spread and Zero accounts, which offer tighter spreads and advanced trading features. Each account type has specific characteristics in terms of spreads, commissions, and available leverage. Traders can choose the most appropriate account based on their trading volume, preferred instruments, and risk tolerance.

| Account Type | Minimum Deposit | Spread | Commission | Max Leverage |

| Standard | $1 | From 0.3 pips | $0 | Up to 1:2000 |

| Raw Spread | $200 | From 0.0 pips | $3.5 per lot | Up to 1:2000 |

| Zero | $200 | From 0.0 pips | From $3.5 per lot | Up to 1:2000 |

| Pro | $200 | From 0.0 pips | $0 | Up to 1:2000 |

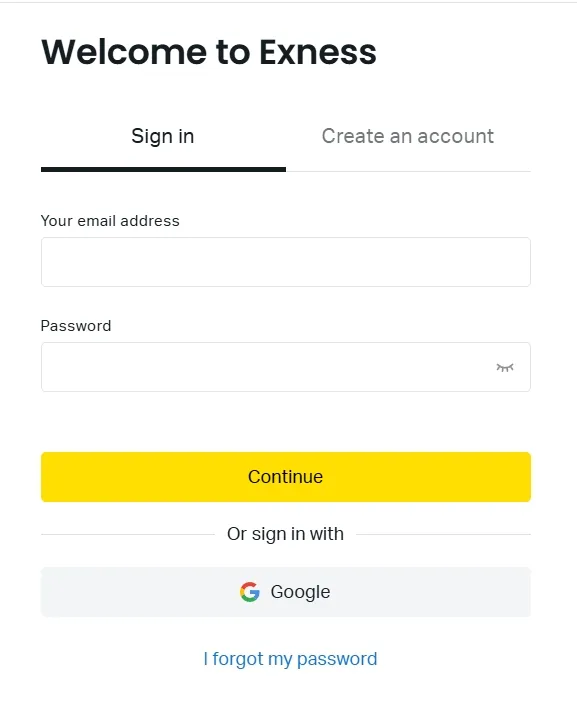

Exness Sign Up Process

The Exness sign-up process begins on the official website, where potential clients can access the registration form. Users are required to provide basic personal information, including full name, email address, and phone number. After submitting the initial details, traders create a secure password for their account. Exness employs advanced encryption technologies to protect user data during the registration process. Upon completing the form, users receive a confirmation email with further instructions to activate their account.

Required Information for Registration

Essential details for Exness sign-up include:

- Full legal name

- Valid email address

- Phone number

- Country of residence

- Date of birth

Verification Document Requirements

Key requirements for verification documents:

- Must be valid and not expired

- Clear, legible, and in color

- Showing full name and address

- Issued within the last 3 months (for proof of residence)

- Unaltered and not screenshot images

Account Verification Procedure

After the initial sign-up, Exness requires account verification to comply with regulatory standards and ensure the security of client funds. The verification process involves submitting proof of identity and proof of residence documents. Acceptable identity documents include a valid passport, national ID card, or driver’s license. For proof of residence, Exness accepts recent utility bills, bank statements, or official government correspondence. Traders can upload these documents directly through their Exness Personal Area.

Funding Your Exness Account

Once the account is verified, traders can proceed to fund their Exness account. Exness offers a variety of deposit methods to accommodate clients from different regions. Common funding options include bank transfers, credit/debit cards, and e-wallets. The minimum deposit amount varies depending on the chosen account type and payment method. Exness ensures that deposits are processed quickly, with many methods offering instant crediting to the trading account.

Popular Deposit Methods

Exness supports multiple deposit options, including:

- Bank wire transfers

- Credit and debit cards (Visa, Mastercard)

- E-wallets (Skrill, Neteller, WebMoney)

- Local payment systems in specific countries

| Payment Method | Processing Time | Minimum Deposit | Fees |

| Bank Transfer | 1-5 business days | $10 | Varies by bank |

| Credit Card | Instant | $10 | No fees |

| E-wallets | Instant | $10 | No fees |

| Local Methods | Varies | Varies | Varies |

Choosing Your Trading Platform

After completing the sign-up and funding process, traders can select their preferred trading platform. Exness offers industry-standard platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as the proprietary Exness Terminal. Each platform provides unique features and tools for market analysis and trade execution. Traders can download these platforms directly from the Exness website or access web-based versions for immediate trading without installation.

Platform Comparison

Key differences between available platforms:

- MT4: Widely used, extensive indicators, ideal for forex

- MT5: Multi-asset platform, advanced charting, more timeframes

- Exness Terminal: Web-based, user-friendly interface, quick access

Setting Up Additional Security Measures

Exness prioritizes account security and offers additional measures for traders to protect their accounts. Two-factor authentication (2FA) is available and strongly recommended for all clients. This feature adds an extra layer of security by requiring a second form of verification during login attempts. Traders can enable 2FA through their Personal Area, choosing between SMS verification or authenticator apps. Exness also provides options for IP restrictions and login notifications to further enhance account security.

Exploring Educational Resources

New traders signing up with Exness gain access to a wealth of educational resources. These materials are designed to help clients understand market dynamics, develop trading strategies, and effectively use the provided platforms. Exness offers video tutorials, webinars, and comprehensive trading guides covering various topics from basic concepts to advanced trading techniques. Traders can access these resources through the Exness website and educational portal, enhancing their trading knowledge and skills.

Types of Educational Content

Exness educational offerings include:

- Platform tutorials

- Trading strategy guides

- Market analysis techniques

- Risk management principles

- Economic indicator explanations

| Resource Type | Format | Access | Skill Level |

| Video Tutorials | Online streaming | Free | Beginner to Advanced |

| Webinars | Live and recorded | Free | Intermediate to Advanced |

| Trading Guides | PDF documents | Free | All levels |

| Market Analysis | Daily updates | Free | Intermediate to Advanced |

| Economic Calendar | Real-time data | Free | All levels |

Customer Support During Sign-Up

Throughout the sign-up process, Exness provides comprehensive customer support to assist new clients. Support channels include live chat, email, and phone assistance, available 24/7 in multiple languages. Traders encountering issues during registration or account setup can reach out to the support team for prompt resolution. Exness also maintains an extensive FAQ section on its website, addressing common queries related to account opening, verification, and initial trading steps.

Frequently Asked Questions:

The Exness account verification process is usually completed within 24 hours after submitting the required documents. However, in some cases, it may take up to 48 hours depending on the volume of applications and the clarity of the submitted documents.

Yes, Exness allows traders to open multiple accounts under a single registration. After completing the initial sign-up process, you can create additional accounts with different specifications (e.g., Standard, Raw Spread, Zero) through your Personal Area.

The minimum deposit for an Exness account varies depending on the account type and payment method. For Standard Accounts, the minimum deposit can be as low as $1, while Professional Accounts typically require a minimum deposit of $200. Always check the current requirements in your Personal Area or with customer support for the most up-to-date information.